Trusted By

Scudo is here to help you safeguard your future

Don't wait to secure your future – choose from Scudo's top insurance products from leading companies and get protected now. Start your coverage today!

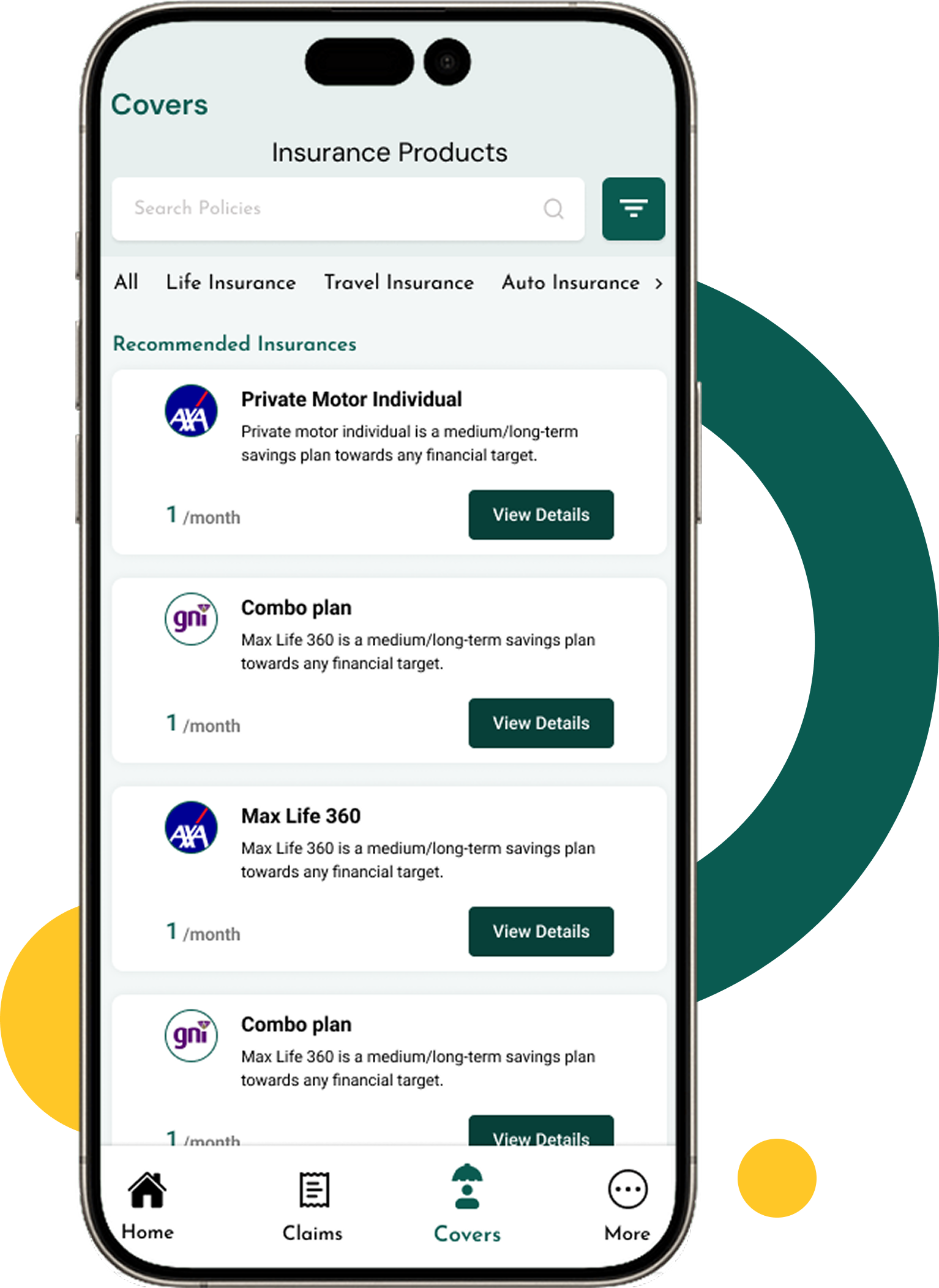

Uncover the Perfect Insurance Solution for Your Needs

Scudo helps you easily find and compare insurance options to discover the perfect solution for your needs.

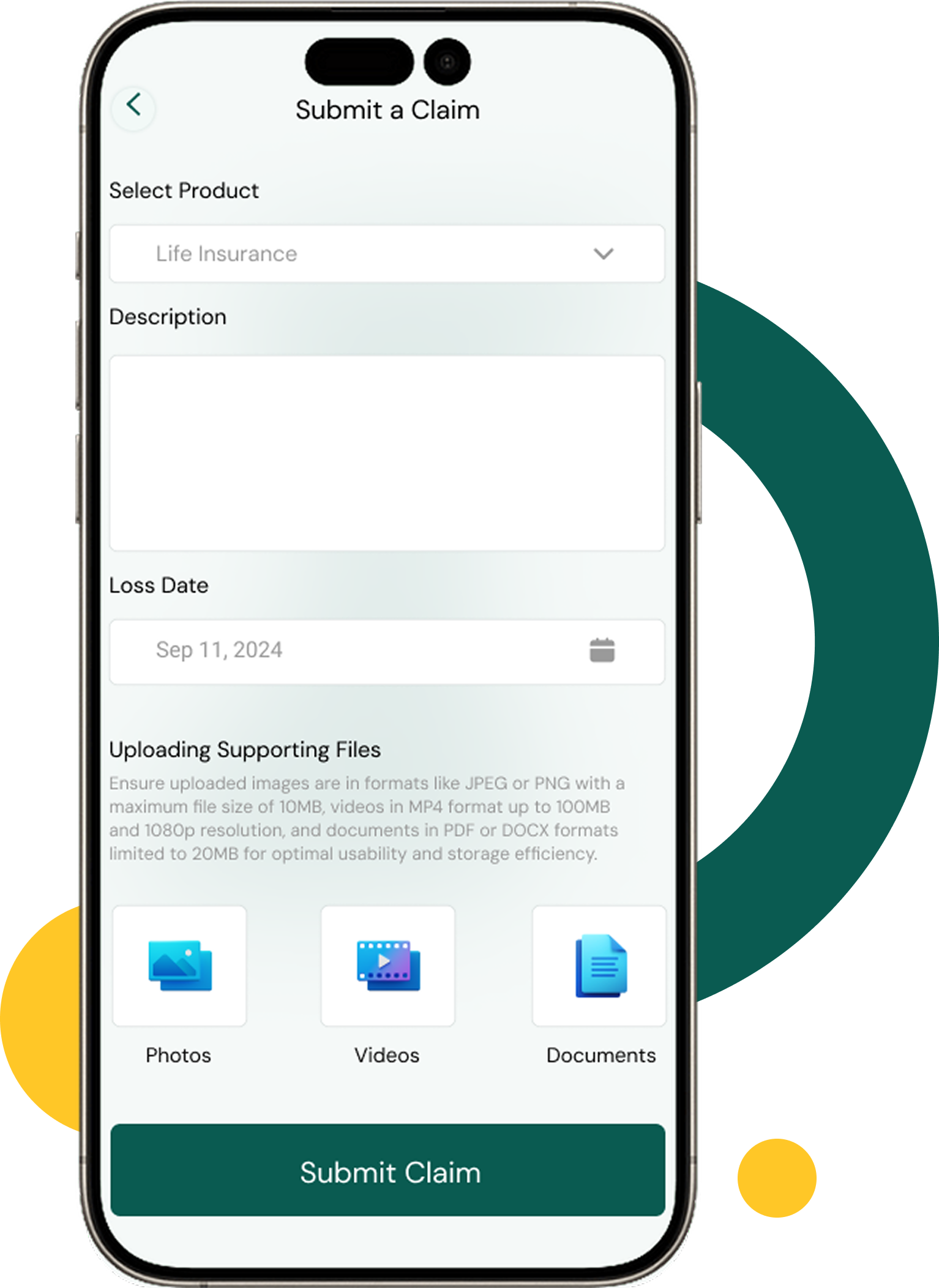

Simplified Insurance Claim Submission

Scudo's insurance claim filling system simplifies the process and allows for quick and efficient submission of claims with just a few clicks. No more stress or hassle.

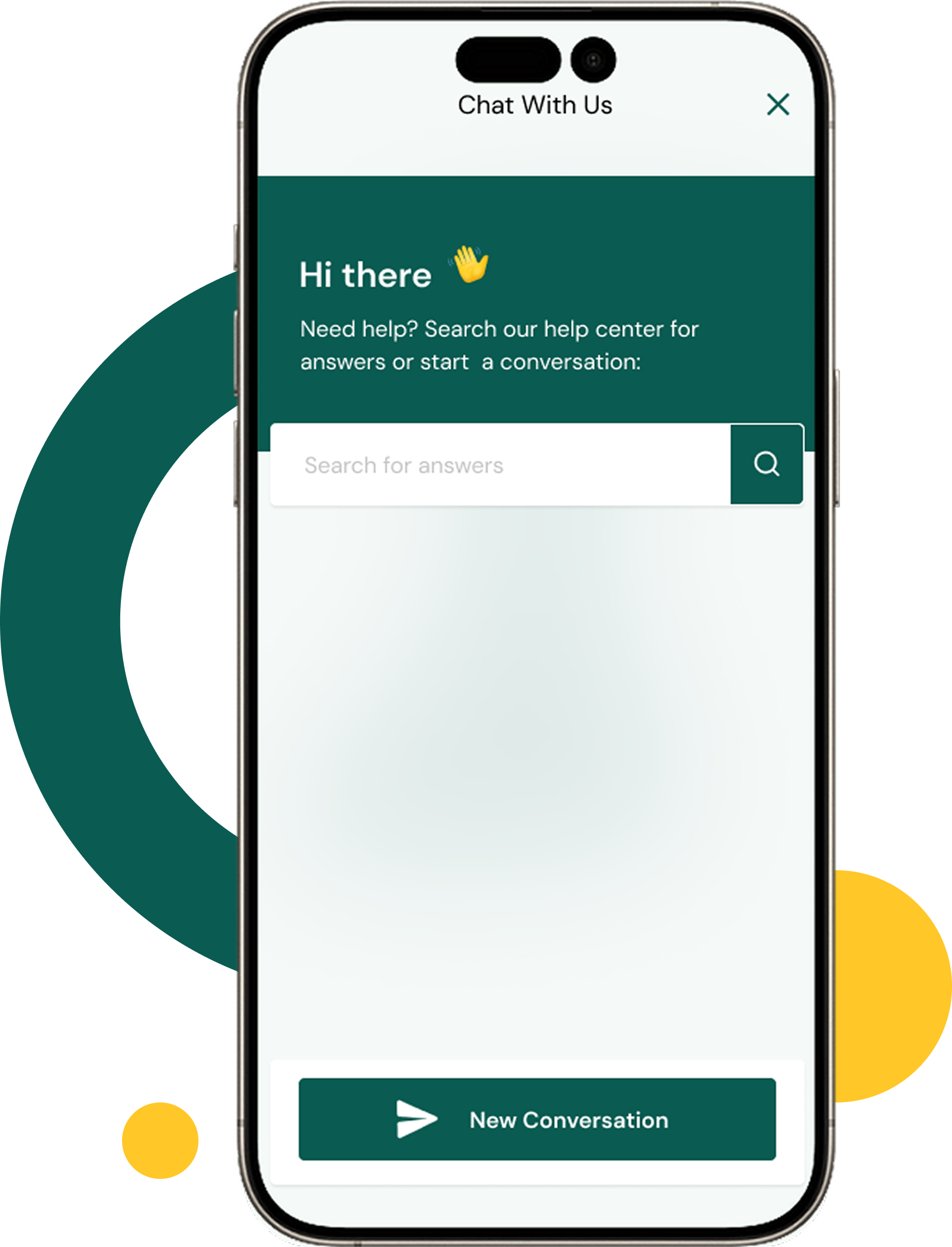

1:1 Direct Messaging

Easily communicate with insurance providers through chat with our platform's real-time feature. No more waiting on hold or phone navigation.

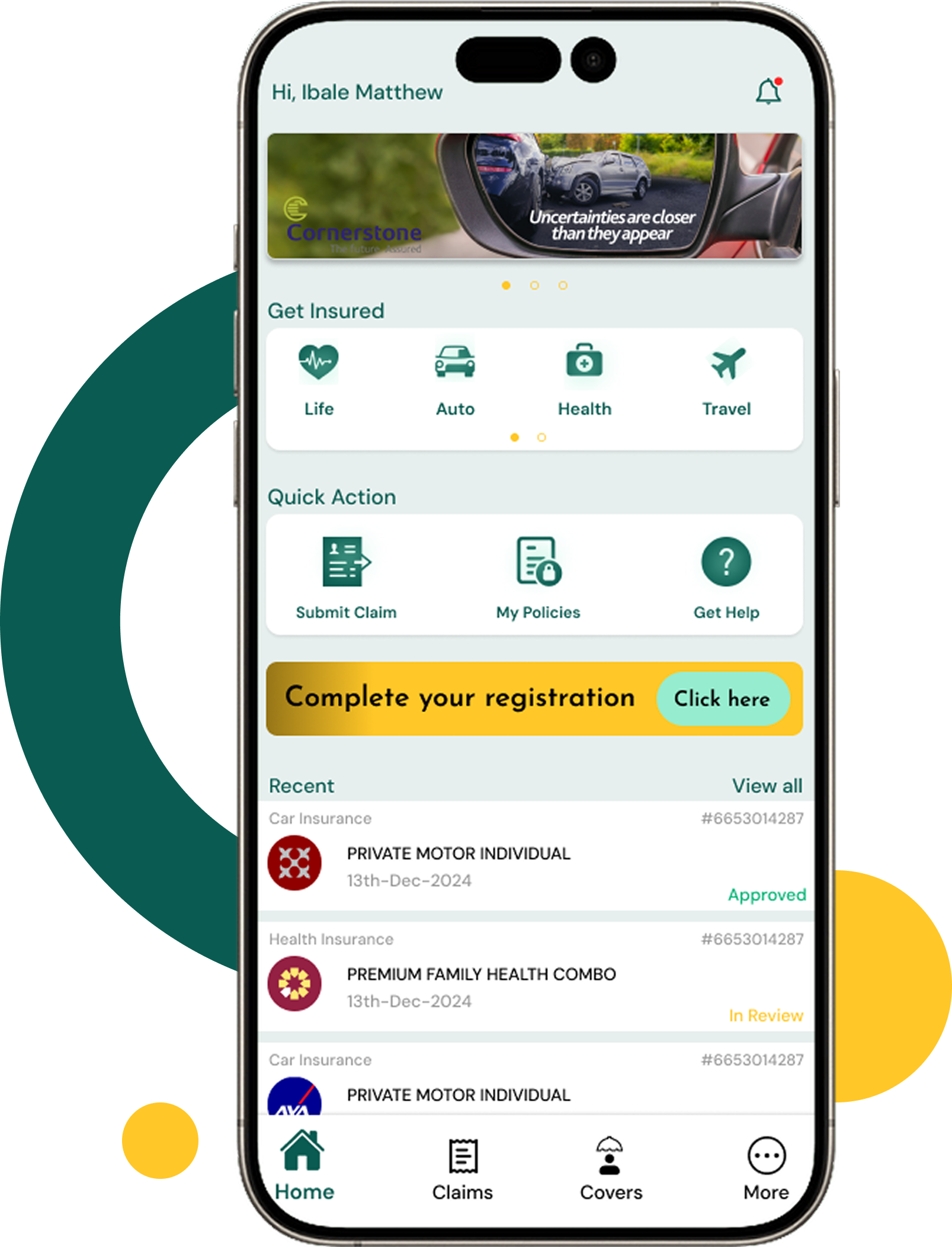

Uncover the Perfect Solution for Your Needs

Are you having a tough time finding the right insurance for you and your family? We're here to help!

Our platform makes it easy to search for and compare different insurance options, so you can find the coverage that fits your specific needs and budget. No more sifting through countless policies – simply use our user-friendly interface to discover the perfect insurance solution for you. Let us take the stress out of finding the right coverage, so you can feel confident and protected.

Chat with Insurance Provider

Communicating with insurance providers doesn't have to be a hassle. With our platform, you can now easily chat with insurance companies in real time. No more waiting on hold or trying to navigate automated phone systems – simply log in to our platform and select the provider you want to connect with. Whether you have questions about a policy or need to clarify details, our chat feature makes it easy to get the information you need.

Experience the convenience and simplicity of Scudo and start chatting with insurance companies today.

Simplified Insurance Claim Submission

Filing an insurance claim can be a stressful and time-consuming process, but it doesn't have to be. With our easy insurance claim filling system, you can quickly and efficiently submit your claim and get on the road to recovery.

Our platform makes it easy to search for and compare Scudo streamlines the claim process, allowing you to easily provide all necessary information and documentation with just a few clicks. No more waiting on hold or struggling to keep track of paper forms. Take the hassle out of filing an insurance claim and use Scudo to get the support you need.

Get the insurance tech API you need for your next project from Scudo!

Get started with our easy-to-use developer documentation and test out our

app on our development environment before production.